OKX Exchange shuts down its service in India and Delists USDT from the European Economic Area (EEA)

Apr

2,

2024

21:35 UTC

|

Updated:

Apr

2,

2024

at

21:35 UTC

OKX

Ceases

Operations

in

India:

Navigating

Regulatory

Challenges

OKX,

a

renowned

cryptocurrency

exchange

headquartered

in

Seychelles,

has

made

the

challenging

decision

to

halt

its

operations

in

India.

This

decision

comes

as

a

response

to

a

multitude

of

regulatory

challenges

and

compliance

issues

faced

by

the

exchange

within

the

Indian

market.

Key

Points:

-

OKX,

a

prominent

cryptocurrency

exchange

headquartered

in

Seychelles,

has

made

the

challenging

decision

to

halt

its

operations

in

India. -

Regulatory

challenges

and

compliance

issues

within

the

Indian

market

have

prompted

OKX

to

reassess

its

presence. -

India’s

evolving

regulatory

framework,

including

Anti-Money

Laundering

(AML)

and

Counter-Financing

of

Terrorism

(CFT)

regulations,

has

posed

significant

hurdles

for

OKX. -

Compliance

notices

from

the

Financial

Intelligence

Unit

India

(FIU)

and

app

removals

by

major

tech

platforms

intensified

pressure

on

OKX. -

The

exchange

communicated

its

decision

to

cease

operations

in

India

on

March

21,

2024,

urging

users

to

withdraw

funds

by

April

30,

2024. -

Detailed

instructions

were

provided

to

users

regarding

account

closure

and

fund

withdrawal,

with

assurances

of

fund

security. -

OKX’s

exit

from

the

Indian

market

reflects

the

complexities

and

challenges

faced

by

foreign

cryptocurrency

exchanges

amidst

evolving

regulatory

landscapes

globally.

Background

OKX

ventured

into

the

Indian

market

between

August

and

November

2023,

eyeing

the

burgeoning

cryptocurrency

sector

in

the

country.

However,

the

journey

soon

encountered

hurdles

as

India

began

tightening

regulations

surrounding

crypto-related

businesses.

Issues

Summary

Regulatory

Pressures

-

Tightening

Regulations:

India

has

been

tightening

regulations

surrounding

cryptocurrency-related

businesses,

mandating

compliance

with

legal

requirements

such

as

Anti-Money

Laundering

(AML)

and

Counter-Financing

of

Terrorism

(CFT)

frameworks. -

Compliance

Notices:

In

December

2023,

the

Financial

Intelligence

Unit

India

(FIU)

issued

compliance

notices

to

OKX

and

eight

other

offshore

companies,

demanding

evidence

of

compliance

with

India’s

rules.

Failure

to

comply

could

result

in

severe

penalties

for

the

exchanges. -

App

Removal:

The

situation

intensified

when

major

tech

platforms,

Apple

and

Google,

removed

the

OKX

app

from

their

platforms

in

India.

This

move

followed

warnings

from

the

FIU

regarding

alleged

non-compliance

with

AML

regulations.

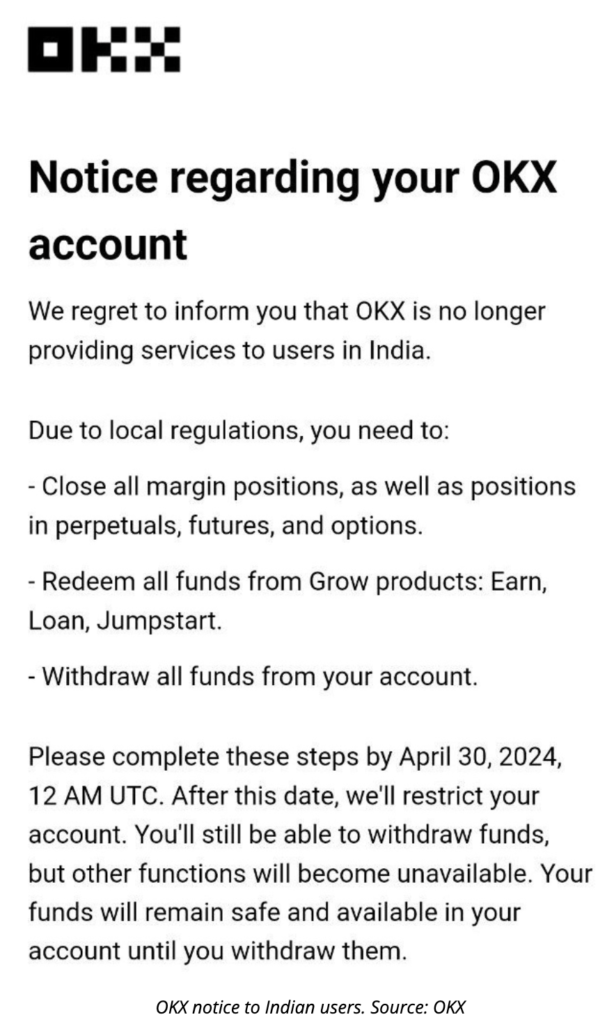

OKX’s

Response

-

March

21,

2024

Announcement:

On

March

21,

2024,

OKX

officially

communicated

its

decision

to

cease

operations

in

India.

The

exchange

urged

its

Indian

users

to

close

their

accounts

and

withdraw

funds

by

April

30,

2024. -

Comprehensive

Closure

Instructions:

OKX

provided

detailed

instructions

to

Indian

users,

including

the

closure

of

margin

positions,

redemption

of

funds

from

Grow

products,

and

the

withdrawal

of

funds

by

the

specified

deadline. -

Assurance

of

Fund

Security:

Despite

the

closure,

OKX

assured

Indian

users

that

their

funds

would

remain

secure

and

accessible

until

withdrawn

from

their

accounts.

Regulatory

Scrutiny

India,

like

many

other

countries,

has

been

grappling

with

how

to

regulate

the

burgeoning

cryptocurrency

industry

effectively.

The

Financial

Intelligence

Unit

India

(FIU)

issued

compliance

notices

to

nine

offshore

companies,

including

OKX,

demanding

evidence

of

adherence

to

India’s

regulatory

framework.

These

regulations

primarily

revolve

around

Anti-Money

Laundering

and

Counter-Financing

of

Terrorism

(AML-CFT)

protocols

under

the

Prevention

of

Money

Laundering

Act

(PML)

Act.

Compliance

Challenges

OKX

found

itself

in

a

challenging

position

as

it

struggled

to

comply

with

India’s

evolving

regulatory

framework.

Compliance

issues,

including

registration

as

a

reporting

entity

and

adherence

to

AML

regulations,

posed

significant

hurdles

for

the

exchange.

App

Removal

and

Compliance

Warnings

The

situation

escalated

when

major

tech

giants,

Apple

and

Google,

removed

the

OKX

app

from

their

platforms

in

India.

This

move

followed

warnings

from

the

FIU

regarding

alleged

non-compliance

with

AML

regulations.

The

exchange

found

itself

under

increasing

pressure

to

address

compliance

concerns

swiftly.

The

Final

Decision

In

light

of

the

regulatory

challenges

and

compliance

pressures,

OKX

made

the

difficult

decision

to

cease

its

operations

in

India.

On

March

21,

2024,

the

exchange

officially

communicated

this

decision

to

its

Indian

users,

urging

them

to

close

their

accounts

and

withdraw

funds

before

April

30,

2024.

OKX’s

decision

to

shut

down

its

services

in

India

reflects

the

challenges

faced

by

foreign

cryptocurrency

exchanges

in

navigating

India’s

regulatory

landscape.

The

tightening

regulations,

compliance

pressures,

and

app

removals

contributed

to

OKX’s

decision

to

exit

the

Indian

market.

As

regulatory

frameworks

continue

to

evolve,

exchanges

like

OKX

must

adapt

to

ensure

compliance

while

maintaining

operational

integrity.

Instructions

to

Users

OKX

provided

clear

instructions

to

its

Indian

user

base,

emphasizing

the

need

to

close

margin

positions,

redeem

funds

from

Grow

products,

and

withdraw

funds

by

the

specified

deadline.

The

exchange

assured

users

that

their

funds

would

remain

secure

and

accessible

until

withdrawn.

Statement

from

OKX

Spokesperson

“We

recently

sent

an

email

to

customers

in

India

who

had

historical

CeFi

accounts

on

OKX,

and

we

are

helping

them

close

out

those

accounts.”

“As

we

offboard

those

customers

their

assets

will

remain

secure

on

the

OKX

platform.

This

decision

was

made

in

response

to

recent

local

regulations

directed

at

offshore

exchanges

that

make

CeFi

trading

available

in

India.

OKX’s

DeFi

Web3

services

remain

available

to

developers

and

creators

in

India.”

Comments are closed.